GET

ON

TRACK

Financial adulting on steroids. Find out if your finances are on track, if your goals are realistic and make a game-plan

COURSE DESCRIPTION

NS-PF 103 – Get On Track

Course Description

Get On Track is financial adulting on steroids. Find out if you’re on track with your finances (for your age and income) and if your goals are achievable within the time frame you want and realistic for your savings! You’ll set goals, prioritize them in a financially responsible way (I know I know.. boring) and get on a realistic budget to move your finances forward. Don’t worry – there’s definitely room for fun and vacations. In addition, this course allows you to see what income you need to be making to meet the spending demands in your life, reach your goals and save. It doesn’t matter what you’re saving for, you need a game-plan. This may just be the best thing that ever happened to your personal finances.

Why Take This Course?

Module 1: Taking Inventory – Are You On Track?

-

- Let’s see where you stand financially! You may be pleasantly surprised!

- Check if your net worth is on track for your income and age!

- Check if your credit score is on track for your goals

- Find out if you’re living within your means!

- Let’s see where you stand financially! You may be pleasantly surprised!

Module 2: Budget Life – How much can we realistically save?

-

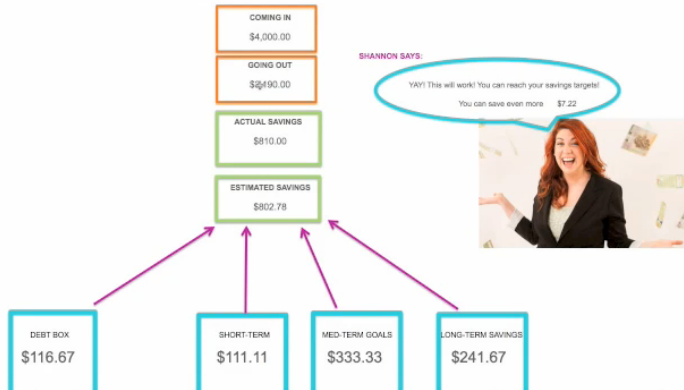

- A REALISTIC BUDGET. I hate the word budget, I prefer “spending guidelines”. When you over budget yourself, it’s like being on an all lettuce diet. It’s not sustainable and eventually you binge. This course will not set you up to fail. It’s realistic and you get to decide!

- Your customizable excel tool will take a hard look at

- What’s coming in

- What’s going out

- How much you can REALISTICALLY SAVE for

- Debt repayment

- Short-term

- Medium Term and Retirement goals

- The only way to reach your goals within the time frame you want is to reduce spending or make more money! We can’t control what we earn in the short-run, so reducing spending where we can get on track ASAP. A budget is the key. THE KEY!

- You can use this tool every year to plan the new year ahead and ensure that you’re on track.

- Your customizable excel tool will take a hard look at

- A REALISTIC BUDGET. I hate the word budget, I prefer “spending guidelines”. When you over budget yourself, it’s like being on an all lettuce diet. It’s not sustainable and eventually you binge. This course will not set you up to fail. It’s realistic and you get to decide!

Module 3: The Plan

-

- Prioritize your goals in a financially responsible way. (i.e. don’t put your retirement at risk so you can renovate the bathroom)

- We only have so much money and we may not be able to do ALL THE THINGS. So, prioritizing is so important to ensure you get biggest financial bang for your buck.

- Figure out what is possible and set realistic time frames (i.e. buy a home in 2 years or 5 years)

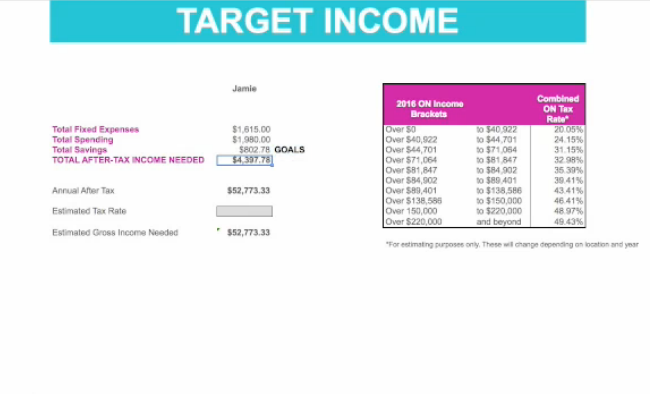

- Find out how much income you need you earn each year (yourself or as a household)

- This is a MUST if you want to renegotiate your salary, get a new job or if you’re self-employed and you want to know how much money you need to earn.

- Prioritize your goals in a financially responsible way. (i.e. don’t put your retirement at risk so you can renovate the bathroom)

What you get:

- Access to 3 insanely helpful and fun video tutorials

- A MEGA-SOLID plan of attack to get your finances in line with your goals on the time horizon you want.

- Customizable, easy and nerdy planning tool! (a bad-ass spreadsheet )

-

- Can be updated as your life changes (as income increases so should savings)

- Creates a Net Worth Statement

- Can be used to track income and expenses

- Shows you when your goals are doable and when they are not (aka, you may not be able to purchase

-

Course FAQ

How Long Is The Course?

Course is 90-120 minutes from start to finish.

What if I'm not on track?

That’s ok! The fact that you even want to take this course (or have taken the course) proves that you are super serious about getting your finances on track. Now you know the work that needs to be done and you’ve got a plan to tackle it. I dare you to implement the savings plan from the course diligently and then one year from now re-do it and see how much you’ve improved! You got this.

Why is it important to do this course?

We all have goals. Everything from going on vacation, paying down debt, buying a home, a cottage, raising a family and putting money away for retirement. We don’t reach these goals by accident (unless you win the lottery). It takes effort and a plan. If you aren’t on track with your finances, you may not reach these goals when you want to, or at all. Say what you want, outline your goals, find out what time frame is realistic and get your plan started!! I’m so excited for you.

Pre-Requisites:

- Ability to open excel spreadsheet, PDF documents, online video streaming (aka the Internet)

This course is ideal for:

-

Anyone who wants to ensure they are saving enough to pay down debt and/or save a boat load of money.

- This course is internationally-friendly!! Not just for Canadians.

Course Restrictions:

- None

$97

Enroll Now!

Meet Your Teacher

Shannon Lee Simmons

Shannon is a Certified Financial Planner (CFP), Chartered Investment Manager (CIM), media personality, personal finance expert, financial literacy advocate and founder of the New School of FinanceTM. She loves helping everyday people survive the new economic climate through personal finance, ethical investing and small business advice. Simmons is widely recognized as a trailblazer in the Canadian financial planning industry and an expert in Millennial personal finances and the digital world and it’s relationship to our money. She was named one of Canada’s Top 30 Under 30 and she recently won the 2014 Notable Award for Best In Finance. She is a regular financial expert on CTV News and also appears as a financial expert in the media, a regular contributor for Toronto Star’s Money Makeover and BBC Capital and host of Coral TV’s Money Awesomeness. Check out her money show here! Strange Quirk: She has put a dollop of red nail polish on the top right of EVERY SINGLE calculator she’s ever had since high school…… why? We aren’t sure, and neither is she.

NOT SO FINE PRINT

- This course and the tool are not to be considered financial, legal or tax advice. The information in this course is for educational purposes only as the information in the material may not totally address your specific financial situation.

- The tool is to be used for educational illustration purposes only. Outcomes that are run in the tests cannot be guaranteed.

- All courses will be charged in USD (based on that day’s USD equivalent to the CAD course price). Your credit card may charge you a different exchange rate or additional fees for foreign transactions.