Guest Post for Swapsity.ca

I spent a year living without money. I saved up enough for rent and my cell phone bill for the year but had to barter for everything else. Spending a year living on the barter system forced me to get out there and put the collaborative consumption model to the test. Can you really live without money? While I don’t think an entirely barter economy is ideal, neither is an entirely cash-based one.

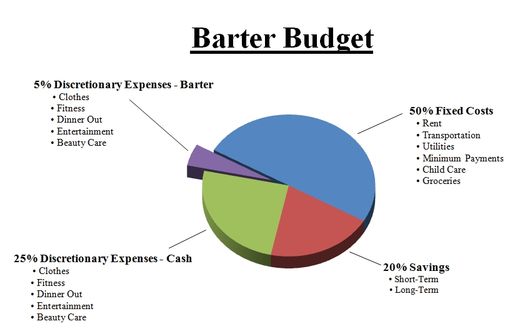

As a financial advisor, I believe that everyone should aim to barter for the monetary equivalent of 5% of their after tax income each month.

A sustainable financial budget is made up of three major categories: 50% of your after tax income for fixed expenses, like housing, utilities, minimum payments; 20% for savings; and 30% for discretionary expenses. Discretionary expenses are everything you spend your money on besides bills, things like clothes, movies, concerts, art, beauty care, and fitness. These goods and services are extremely easy to barter for and a great place to bring barter into your life.

As gas and housing costs rise, it’s hard to keep fixed costs at only 50%. Barter is the perfect way to correct for this. If you make a conscious effort to barter at least 5% of your after tax income, you can still maintain your standard of living and keep spending off credit cards.

To implement this strategy:

- Make a list of all your monthly discretionary expenses.

- Highlight the ones you can barter for quite easily.

- Choose enough barter-friendly expenses that add up to 5% of your after tax income.

- Actively attempt to barter for them instead of spending cash.

For example: a person makes $40,000/year, which is $2500/month after tax. Their monthly condo fees just went up by $125/month, pushing their fixed costs from $1250/month to $1375/month, 50% to 55%. This increase in fixed costs puts pressure on their ability to save 20% or enjoy the 30%.

In the mixed barter/cash economy, rising fixed costs are not as scary. If this person barters the monetary equivalent of 5%, or $125/month, their life utility remains the same. This could be done by bartering for any regular expenses, including haircuts, clothing, aesthetics, and computer repairs.

Now this person will have 55% fixed costs, 20% savings, 25% discretionary expenses and 5% barter. They keep the same standard of living and savings even with the rise in bills.

Taking the idea one step further, if fixed costs are under control at 50% and you still barter for 5%, you can save more or spend more depending on your goals.

At 5%/month, $125, that would be $1500/year in savings — sounds pretty great to me.

Bartering helps you save more and spend less.

It’s financially smart to barter!

Recent Comments