Misconceptions abound about what to write-off. After all, if it was so easy to figure out what was deductible, then no one would pay an accountant!

The question of whether you can write off gluten-free food is a question that covers two important societal questions:

1. Why are you not eating food with gluten don’t you know they are delicious?

2. What tax credits are you missing and how much money could you be saving?

To the first question: if you are eating gluten-free foods just because you think Wonderbread will make you gain weight, you feel a slight bloating after shoving down too much pasta and you want to have an Instagram body worthy of the hashtag “inspo”, then no you can’t deduct any money from the tax you owe.

However, if you are eating gluten-free foods because a doctor tested you and discovered that gluten is damaging to your small intestine then congratulations! The Government of Canada in all its glory and kindness has bequeathed on you a tax credit!

Keep the receipt every time you buy a product marketed for gluten-free diets and deduct the cost from the average cost of a non-gluten-free product. You’’ll get a tax credit from the difference, because gluten-free products are more expensive (as you’re well aware).

Check out the details here.

Now, to the second question, what else could reduce the amount of tax you owe? What other tax credits and deductions are lurking behind the unattractive but functional Canada Revenue Agency website?

Here’s five tax credits and deductions you may have missed:

- Interest paid on your student loans

- Art classes for your child

- A safety deposit box where you’re obviously keeping your priceless rubies and silver

- Buying your first home

- Moving at least 40 km closer to your work or school

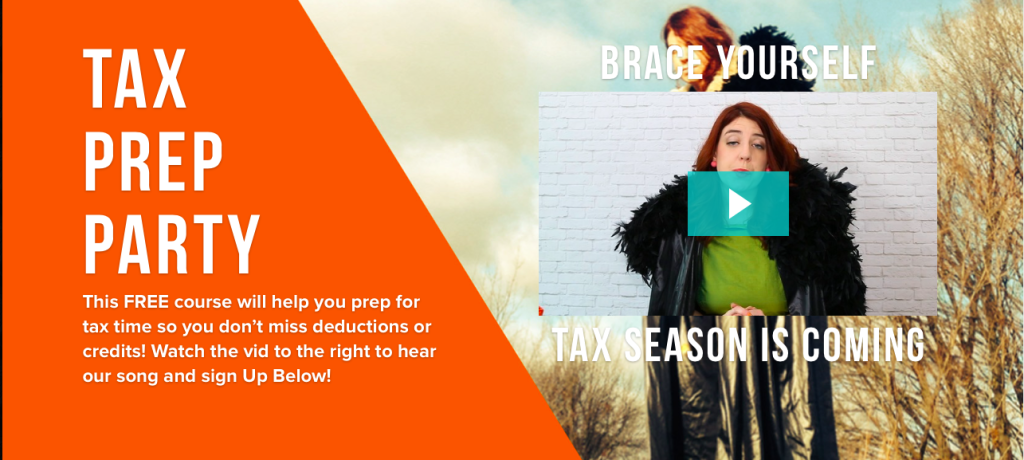

To learn more about how to save your precious money from the government, check out The New School of Finance’s FREE online course Tax Prep Party !

Recent Comments