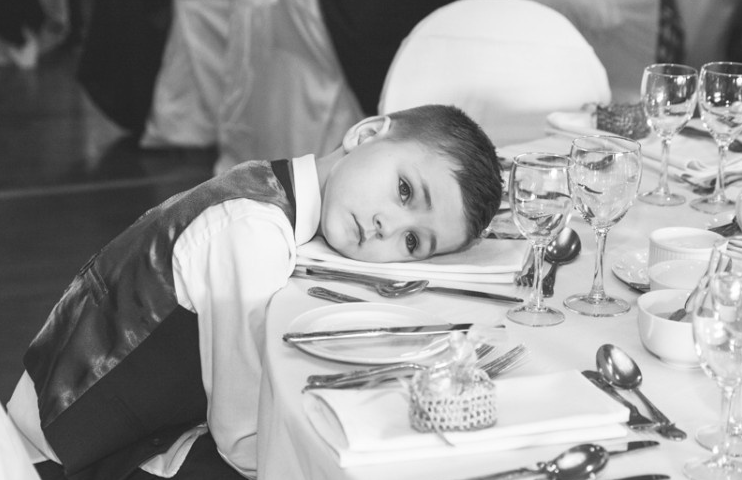

By now, we all know that getting married is expensive. Like, really expensive. The average cost of a wedding in Canada is $31,500 – which is enough to make a person feel like:

Even if you never want to get married yourself, you’ve probably experienced another matrimonial financial burden that many of us have grown very accustomed to…that of the wedding guest. Many of us have hit that age where suddenly it seems like everyone around us is getting married, every year, all the time.

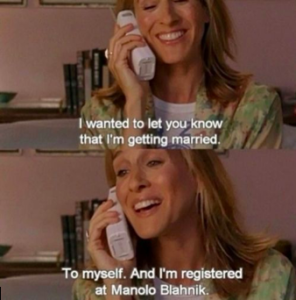

Sometimes – especially if you don’t plan to get married yourself – the endless weddings, showers, and associated parties can be enough to make you want to pull a Carrie Bradshaw (outdated pop culture reference alert!)

But of course, you absolutely love celebrating your friends and their loving partnerships. You cry with everyone else during the beautiful ceremonies. You squeal “Best. Wedding. Ever!” at literally every wedding you attend at some point while on the dancefloor. But the cost of attending all these weddings is still often an issue. You’re not alone: 43% of Americans have declined an invitation to a wedding due to the associated financial cost.

It’s easy to understand why – the average cost to attend a wedding is now $703. If you’re a millennial, you’ll spend 27% more than the general population – $893, to be precise.

Of course you want that outfit to be on point. Then there’s travel and accommodations; even if it’s not a destination wedding, sometimes it’s a destination to you – Winnipeg, anyone? Occasionally, there’s the dreaded cash bar. It adds up quickly, and did I mention that $893 does not include the showers and bachelor/bachelorette parties and is only if you’re not in the wedding party? Be honest: when your best friend asks you to be a part of their wedding, even though you love them and are so excited and happy to help, you’re still thinking:

And of course: the gift. We spend an average of $99 on a wedding gift for a friend, and of course that’s more if the happy couple is family.

A simple Google search will bring up hundreds of results about how to keep your wedding attendance costs down. Carpool! Rent a big AirBnB with friends instead of staying in an expensive hotel! Recycle your wedding attire! At the end of the day, though, you’re still going to have to shell out some money to celebrate with your loved ones. Attending a wedding often results in a spike in spending – and when we aren’t prepared for it, we are more likely to go into debt in order to join the party. In fact, 36% of wedding guests admit that they have taken on debt in order to attend a friend’s nuptials.

The very thought of all those wedding guests going into debt – along with the bride and groom themselves who often take on debt to throw their big party – gets all of our panties in a bunch over here at the New School of Finance. Disagreements about money are the top predictor of break-ups and divorce, and this year we want all the wedding guests, newlyweds and brides- or grooms-to-be to be bicker free! Let’s all save a little bit each month towards a “Wedding Fund” or – if the damage is already done – towards paying off those pesky credit card bills. If you’re currently single, check out Get On Track to kick start this new savings plan, and if you’re already shacked up, Budget With Your Boo has got you covered.

Did we mention that at $97 Budget With Your Boo clocks in at just under the average wedding gift price? It is, without a doubt, infinitely more thoughtful and practical than that gravy boat they will only use once a year. So until the time when all our friends and family get married nearby and happily accept gifts that have clearly been acquired in a Bunz trade, make a smart plan to save for wedding season. And hey, if you don’t get any wedding invites next year, you’ll have mad cash to go and spend like Tom and Donna would!

Lead photo: Livia Figueiredo

Recent Comments